FASTCash for Linux

Analysis of a newly discovered Linux based variant of the DPRK attributed FASTCash malware along with background information on payment switches used in financial networks.

Introduction

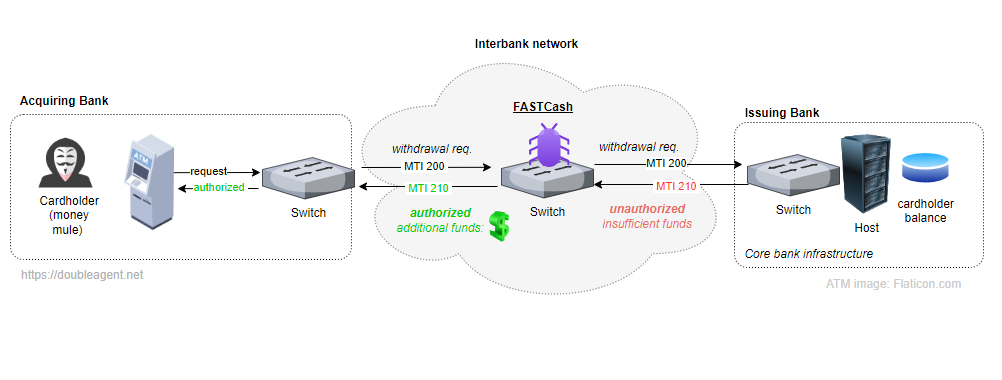

This post analyzes a newly identified variant of FASTCash "payment switch" malware which specifically targets the Linux operating system. The term 'FASTCash' is used to refer to the DPRK attributed malware that is installed on payment switches within compromised networks that handle card transactions for the means of facilitating the unauthorized withdrawal of cash from ATMs.

Discovery of a Linux variant adds to the list of operating systems that this malware has been compiled for, with prior samples known to target IBM AIX (FASTCash for UNIX) and Microsoft Windows (FASTCash for Windows). As per an updated amended to CISA's 2018 advisory for the Windows variant:

Since the publication of the in October 2018, there have been two particularly significant developments in the campaign: (1) the capability to conduct the FASTCash scheme against banks hosting their switch applications on Windows servers, and (2) an expansion of the FASTCash campaign to target interbank payment processors.

The first submission of 'FASTCash for Windows' to VT was during September 2019, and first was publicly referenced by CISA in 2020. During the author's discovery of the Linux variant, additional Windows samples have been identified which were submitted to VT within the month of June 2023, overlapping in time with the Linux variant submission. (Notably, the most recent Windows variant with a previously unreported hash was submitted is in the month of September 2024)

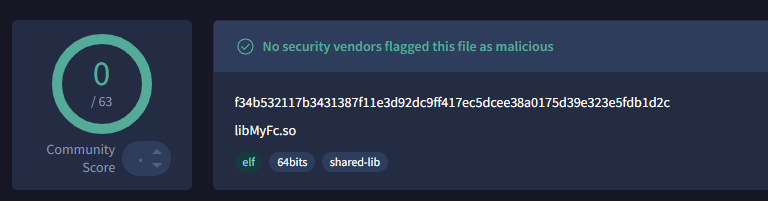

Newly unattributed Windows samples have some detections (likely) due to the process injection methods used, although the Linux sample that is the primary focus of this post, has no detections as of writing:

IoCs can be found and the end of this post.

Based on analysis of CISA's reported Windows sample against the Linux sample, both are are targeting very similar or the same payment infrastructure (bank or interbank network) within the same country - this assertion is made based on the unique properties of the fraudulent transaction responses that both variants share. Further details on this attribution can be found in the technical analysis later in this post.

The Linux sample that is of primary focus here is has been compiled for Ubuntu Linux 20.04 and developed sometime after April 21 2022 (based on compiler version), most likely developed in a Virtual Machine using the VMware hypervisor.

The Linux variant has slightly reduced functionality compared to its Windows predecessor, although it still retains key functionality: intercepting declined (magnetic swipe) transactions messages for a predefined list of card holder account numbers and then authorizing the transaction with a random amount of funds in the currency of Turkish Lira.

The FASTCash for Windows sample (switch.dll) reported in CISA/DHS MAR-10257062-1.v2, which cites attribution to HIDDEN COBRA.

Analysis done between the AIX and the original Windows variant by Kevin Perlow presented in his Blackhat 2021 talk and related related paper. As such, this post will specifically focus the newly identified Linux variant and its relation to the original Windows variant.

The next section of this post will attempt to explore in detail the terminology and technology related to card transactions processing systems. The intention of this section is to help facilitate the understanding of concepts fundamental to card transaction platforms.

Skip to Part 2 around midway in this post if you would rather head straight into the analysis of the Linux variant.

Part 1 - Terminology and Technology

Parties involved

First we start with terms used to refer to parties which may participate in a (credit or debit) card transaction:

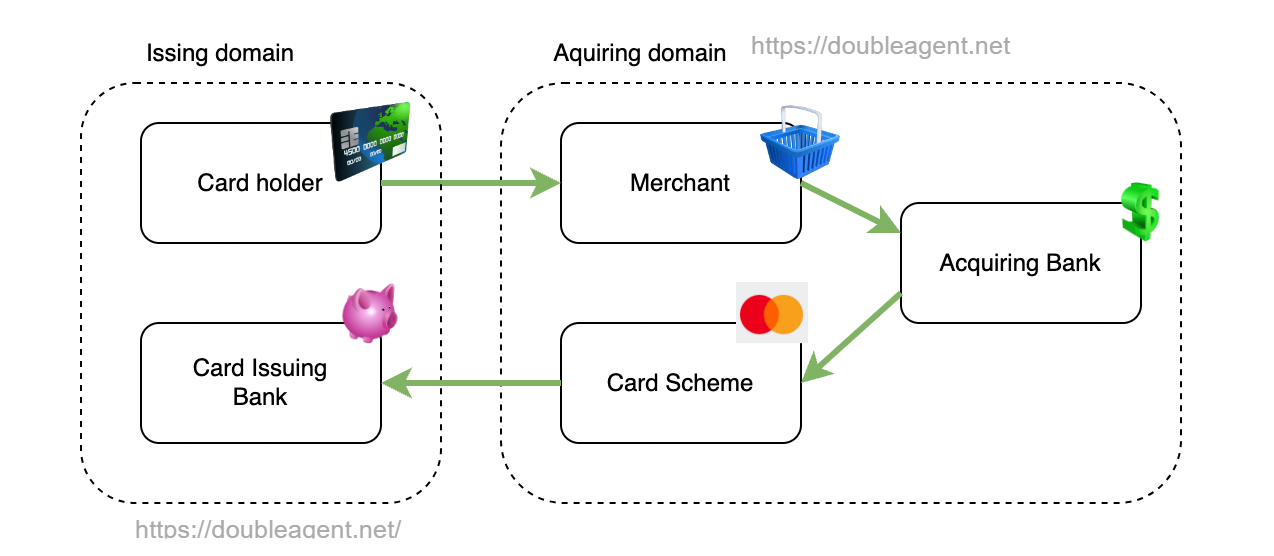

- The acquirer (or merchant acquirer, or acquiring bank) enables a merchant to accept payment to a cardholder. For example, this is the bank a retail shop uses to enable their customers to make payments. The acquiring bank owns the ATM/PoS terminals and associated switch software and interchange connectivity.

- Issuer - The bank or financial institution that provides the credit or debit card to a customer. Within the context of the switch system, the issuer is the one that responds to acquirers with an approval or rejection message for a transaction. An issuer can be the acquiring bank.

- Card Scheme / Card Network such as Visa, Mastercard etc. In these examples, the card scheme is an intermediate party between the acquirer and issuer. There are exceptions, for example AMEX could also be the issuer. The issuing bank is a member of the card scheme.

To illustrate better, the following diagram assumes the card holder makes a purchase on a credit card. The shop terminal reads the card data and sends it to the shop merchant's acquiring bank. Since the card holder belongs to a different bank, the request is sent to the card network (Visa, Mastercard etc.). The card issuing bank (the bank of the shopper) then does balance checks and so forth.

Payment switch

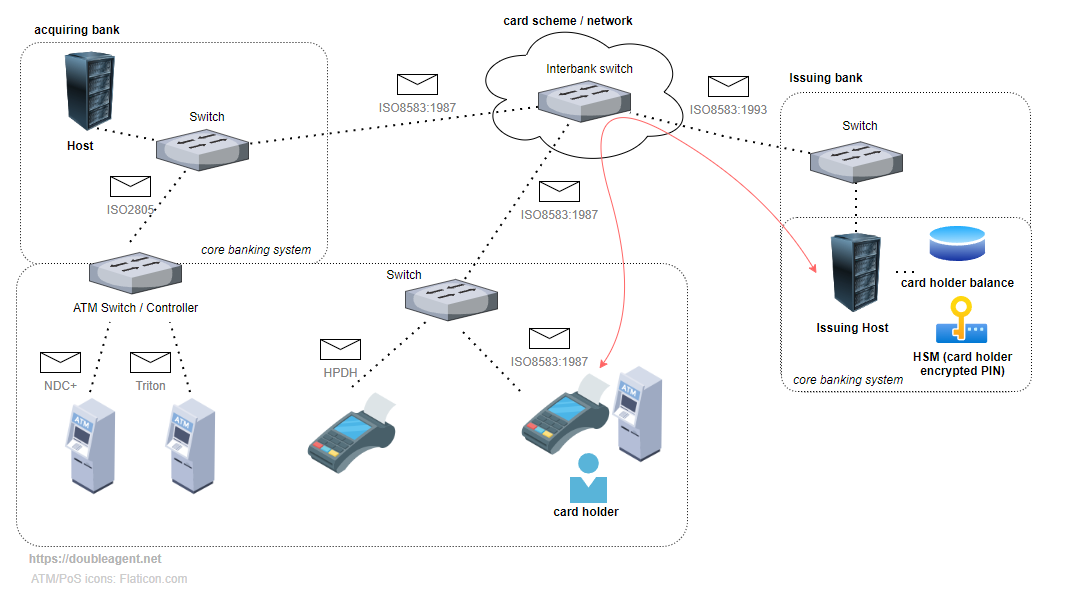

A "Switch" is an intermediary routing system for the card transaction messages. They may connect multiple endpoints (ATM/POS terminals) to bank Hosts or provide a transit between parties such as interbank networks to perform duties such as routing of transactions, protocol conversion, and reporting/logging. Here "Host" may refer to a financial institution's core banking systems that perform the actual financial transaction against the card holder's account.

FASTCash malware which tampers with transaction messages could happen within a userspace process on a compromised switch where the message digest code either missing or not validated. The following diagram helps illustrate the role and placement of payment switches or ATM controllers.

In the above diagram we have an assortment of ATMs and PoS terminals speaking a mixture of protocols. The switches are also speaking different dialects of ISO8583 for interoperability between payment networks. The core banking systems (Centralized Online Real-time Environment) handles the actual transaction processing for the card holder (for example, depositing or withdrawal of funds from their account. The cardholders PIN used to authorize the transactions will be encrypted in a HSM)

Protocols and Interfaces

Central to all of this is the ISO8583 message format. The standard, known as "Financial Transaction Card-Originated Messages — Interchange Message Specifications", details the format and standard for debit and credit card transactions: actions such as checking a balance, withdrawing cash from an ATM or making a purchase from a Point of Sale terminal at a retail store. The fields are called "data elements" and are referenced by an integer number. Proprietary platforms or payment networks that process these messages will detail the meaning and format of data elements specific to their implementation. These specifications can get quite lengthy, often spanning many hundreds of pages in length.

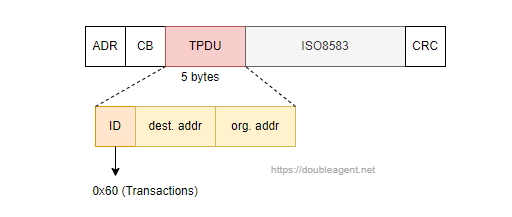

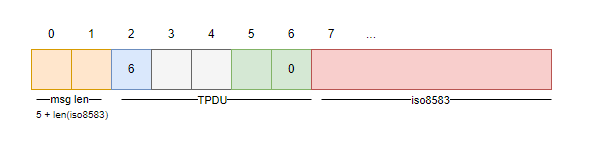

ISO8583:1987, established upon an older standard by ANSI, X.92. Before the ANSI standard gained adoption starting within the early 1980s, financial institutions used their own developed protocols and message structures. A newer (and generic standard, not just limited to card transactions) is ISO20022 that is represented in XML or encoded in ASN.1. Again, different payment networks or even countries may have their own derivates based upon ISO8583. For example, in Australia this is known as AS2805 which is used for EFTPOS transactions. While the standard does not define the transport protocol, these days it is common for TCP/IP to be used between Switches. Predating the Internet as we know it, many public and private packet switched networks were X.25 based and often used in financial networks - and quite possibly still is in some places. Remnants of X.25 still apply to today when referring to card transactions - the ISO8583 standard does not specify how to route the messages over the network, and as such, a TPDU (Transaction Protocol Data Unit) was often used. The TPDU may include the origin and destination addresses (e.g. terminal and national network) and a message length. Once upon a time, hardware routers existed that supported these messages over X.25 packet switched networks and within HDLC/SDLC links. In addition to a TPDU, a 16 bit unsigned integer is often prefixed before the PDU to indicate the message length (including the PDU length of 5 bytes).

We will see later that linux.fastcash (and the Windows variants) expects ISO8583 messages to include both a 2 byte message length and TPDU prefixed before the ISO8583 message.

Terminals

Automatic Teller Machines

ATMs are often connected to a network via dial-up/ASDL or leased lines. While most modern ATMs support TCP/IP, supposedly, the 1960's IBM BSC / Bisync protocol may still be used in old ATMs, such as BSC3270. ATM vendors often have have their own proprietary protocol such as NDC/NDC+ (NCR Direct Connect), DDC (Diebold Direct Connect) and Triton. While not published in the public domain, documents related to these standards can be found on the Internet. At some point a global standard, CEN/XFS was introduced which relieved the "vendor lock-in" in regards to mandating a specific ATM vendor's supported controller/switch product.

Point of Service

These days we often spot PoS terminals using connectivity over a telecom network or twisted pair over the PSTN. Older PoS terminal devices may have required a POS concentrator. Taking an example - a very early proprietary PoS protocol (like many, based on ISO8583) is called HPDH (Hypercom POS Device Handler). Specification documents (again, found by an Internet search) details a HDLC frame which includes a 5 byte TPDU with a fixed ID number 0x60 which corresponds to the message type "Transactions":

The use of 0x60 in a PoS TPDU appears common across different vendors and and implementations, perhaps inherited from Hypercom. The Windows and Linux FASTCash variants use very specific values in the TPDU header which could possibly provide pointers what kind of systems the infected switch(s) are interfacing with. More in this later.

More on ISO8583

Let's take a look at some of the fields within the standard:

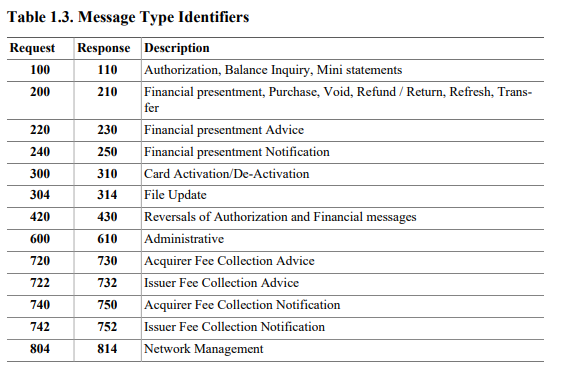

MTI- Four digits that indicate the source and function of the message.linux.fastcash(and the other related variants) support100/110(balance enquiry) and200/210(financial transaction). Balance checks (MTI 100) are likely used to verify that the malware is working by verifying that the card holder has fraudulent amount of funds in their account.

- Bitfield - A bitmap that marks which fields are present in the message. The position of the bit represents the data element ID number.

- Data Element - The actual field that contains the information for a transaction. The standard specifies the meaning and format of many of these fields, but not all. We will come across custom formats with the FASTCash malware which is likely specific to the target's network or Switch implementation. When we refer to data elements, the convention

DEwill be prefixed with the element number.

A description of some fields:

DE2(Primary Account Number) - The PAN, or customer account numberDE3(Processing Code) - The response code. FASTCash checks this code to determine if "insufficient funds" is being returned from the issuer for a transaction.DE4(Transaction Amount) - Typically the value of the funds, for example, amount being requested to be withdrawn.linux.fastcashuses a different field for this.DE22(Point of Service Entry Mode) - The mode and PIN availability. Here FASTCash looks for Magnetic Swipe mode.DE49(Transaction Currency Code) - The currency code (as perISO4217) of the funds.linux.fastcashand it's Windows equivalent specifiesTRYand a prior AIX variant can be found to useINR.DE52(PIN) - Encrypted PIN which might be omitted if a PIN was not used (e.g. customer signed). In the case oflinux.fastcashand it's prior Windows variant, the malware explicitly removed this field and the associatedDE53(Bin Block) fields.

A valuable reference document is "jPOS Common Message Format".

Integrity and Encryption

FASTCash malware targets systems that ISO8583 messages at a specific intermediate host where security mechanisms that ensure the integrity of the messages are missing, and hence can be tampered. If the messages were integrity protected, a field such as DE64 would likely include a MAC (message authentication code). As the standard does not define the algorithm, the MAC algorithm is implementation specific.

MAC algorithm is the encrypted TSK (Terminal Session Key) from a commonly used Master/Session key management scheme used in ATM/PoS devices (MK/SK is being replaced by DUKPT) and many vendors support both). PCI standards publishes a list of approved PTS (PIN Transaction Security) devices which gives an idea of the symmetric key algorithms and key management schemes employed here). In an ATM, a device here is the actual "PIN keyboard" which encrypts the PIN very early on - and hence the ATM O/S (often running Microsoft Windows) is never exposed to the customer's (plain-text) PIN number.FASTCash malware modifies transaction messages in a point in the network where tampering will not cause upstream or downstream systems to reject the message. A feasible position of interception would be where the ATM/PoS messages are converted from one format to another (For example, the interface between a proprietary protocol and some other form of an ISO8583 message) or when some other modification to the message is done by a process running in the switch.

Operating systems and platforms

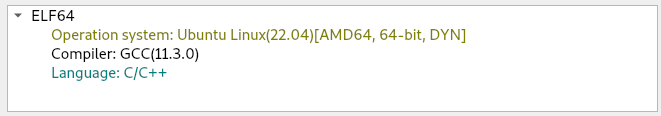

linux.fastcash sample was compiled for Ubuntu Linux 22.04 (Focal Fossa) with GCC 11.3.0. ATM switch software running on Ubuntu Linux though? Let's dig a bit further into the ecosystem to see if this fits. It goes without saying that performance (fast I/O) and high availability is paramount in core banking infrastructure. Examples of well known companies that develop switch software for banks include ATOS, ACI (Base 24) and BCP (SmartVista). This type of software could be found supported to run on "mainframe" or equivalent fault tolerant type platforms manufactured by IBM, HP and others.

A Google search away reveals documentation and commercial presentations for traditional ATM switch software vendors which mostly advertise support for proprietary UNIX-like systems and Microsoft Windows. For example, in addition to AIX and Windows, BCP has advertised that it had supported being run on Redhat Linux. More recently, companies have emerged on the scene with their switch software running in the cloud (e.g. AWS) and in containers. There are switch software vendors that do advertise generic support for Linux, although their names will be omitted here to avoid possible confusion/mistaken attribution.

Visa state that a maximum capacity of 65,000 transactions per second: That's actually a very high number in respect to financial transactions. At least historically, central switch software likely was developed in-house and written in assembly for the z/TPF. To give an idea of the scale of this transaction processing capability, for reference, a commercial presentation dated 2010 found on the Internet describes a load test simulation with 17,000 ATMs and 27,000 trade terminals resulting to 650 transactions per second loading a (now dated) HP Integrity Superdome 2 (Itanium 9350 w/64 cores) running HP-UX at 75% CPU usage.

On the topic of HP, in the 1970s, a primary competitor to IBM's mainframes was Tandem, a "dominant manufacturer of fault-tolerant computer systems for ATM networks, banks, stock exchanges". Tandem's NonStop fault tolerant system exist today in a different form, absorbed (or died off) within HP Enterprise. Here is a relatively recent article on Tandem and fault tolerant systems which makes for an informative read.

To summarize this section, at least traditionally, does not really fit into core bank system infrastructure. With the increased adoption of opensource, it's certainly likely that other commercially supported Linux distributions could be found elsewhere in payment networks on systems that handle card transaction messages. On the topic of opensource, jPOS is a well known open source payment switch software - with numerous newsgroup discussions revealing developers discussing integration into both ATM and PoS related platforms. Someone has even driver available for jPOS which adds support for the proprietary NDC ATM protocol.

Another theory on the Ubuntu Linux connection is that the malware developer was just using this as a base O/S for development purposes and planned on compiling it for a different platform at a later time.

Part 2 - FASTCash for Linux Analysis

Attribution

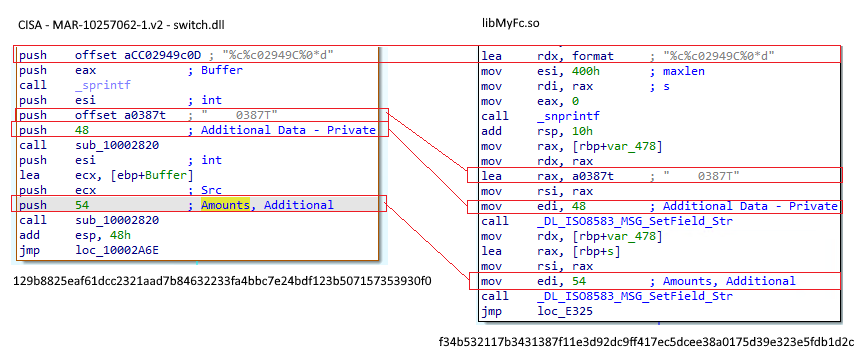

CISA's report "North Korean Remote Access Tool: FASTCASH for Windows" references a malware sample that manipulates ISO8583 transaction messages in the same manner. Both the Windows and this Linux sample:

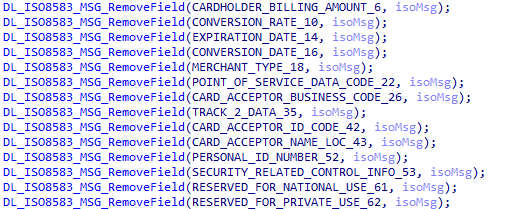

- Generate a random amount of Turkish Lira to be fraudulently added to the authorization response messages.

ISO4217value of949representing Turkish Lira is specified inDE54(Additional amounts). DE48("Additional data, private) uses the same custom value of0387Twhich is likely specific to it's target payment processing systems. Think ofDE48as a custom field - meaning is dependent on what is specified for a specific network. The meaning of0387Tmight be very specific to a specific software vendor, or it could be a localized customization.- Both samples strip out 14 specific data elements when tampering with the authorization response message. Many of the elements are marked "Reserved for private" as per the

ISO8583standard. It is unknown why this was done.

There are some similarities in the relevant code segments on the Windows (switch.dll) and Linux "libMyFc.so" variants in how the response message is constructed. The format string for currency format and the additional data elements match. "Additional Data - Private" could be considered a "free text field" as per the ISO8583 standard, and is assumed to be implementation specific.

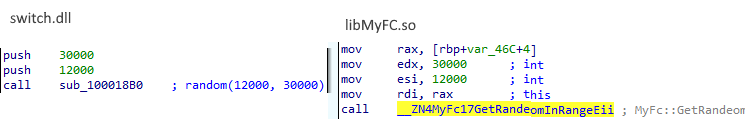

The range for the random funds amount generated per fraudulent transaction is the same (12000 to 30000):

Also similar is the hooking into the recv call of a target process, validating the transaction type (MTI 1xx,2xx) to ensure that the transaction was from a magnetic swipe.

Both samples expect packets with a 2 byte message length, followed by a 5 byte TPDU. Both samples also add a constant value of 0x06 in the first byte and 0x00 in the last byte of the of the TPDU. It is unclear why this is done without knowledge of the downstream system(s) that will receive the fraudulent response message.

linux.fastcash has reduced functionality compared to its Windows and AIX variants. For example hardcoded IP checks and incorrect PIN handling is not present.

In respect to the ISO8583 message response message validation, there is a slight difference: The DE3 (processing code) response values that are checked to match a balance enquiry or withdrawal differ in the their integer value (although the implementation of how the messages are tampered is the same). This difference may reflect that the Linux version runs on switch software that interfaces with a slight deviation in the representation of the processing code data element. That said, the subsequent tampering in both the balance enquiry and withdrawal are the same.

Implementation

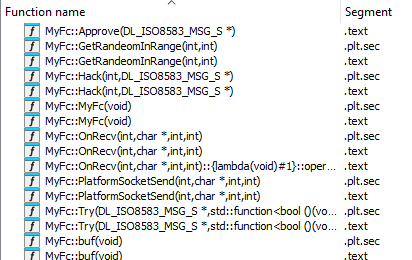

Unlike other prior samples, the Linux variant is mostly written in object orientated C++ and was not stripped, maintaining global variables and class names. The purpose of each member function of the MyFc class is self evident:

It is likely that GCC 11.3.0 was used to compile the source on Ubuntu Linux 22.04:

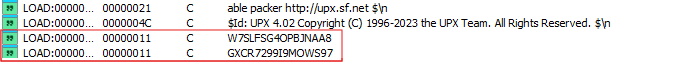

One identified sample was partially packed with UPX version 4.02. It is unlikely that this was used, as UPX is not compatible with ELF shared libraries. Notably, not all sections were successfully packed:

Initialization

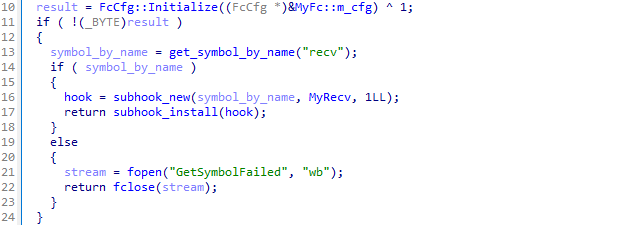

The malware is implemented as a shared library, intended to be injected into a existing running process by utilizing ptrace. Code is likely taken from process_injection_example to invoke ptrace which then relies on subhook to setup the hook into glibc's recv

If the address of recv cannot be found, an empty file with the name GetSymbolFailed is written to the current working directory.

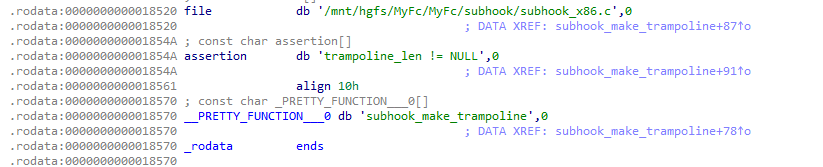

The /mnt/hgfs path points to the VMsare hypervisor possibly being used during development.

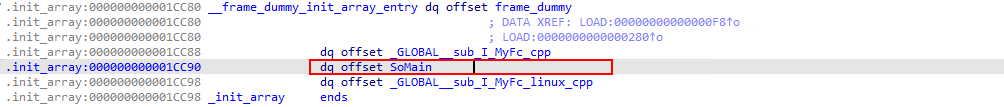

/mnt/hgfs VMware uses hgfs file system for mounting volumes between host and VMThe initial entry point to SoMain is invoked upon loading the shared library, with the address of the function being an entry in the .init_array section. Likely with the original source having been decorated with the __attribute__(constructor))).

SoMain attempts to decrypt the configuration file by calling the Initialize constructor of the FcCfg class, and then if successful resolves and hooks into glibc's recv function in order to parse incoming packets from the hooked processes' network socket(s).

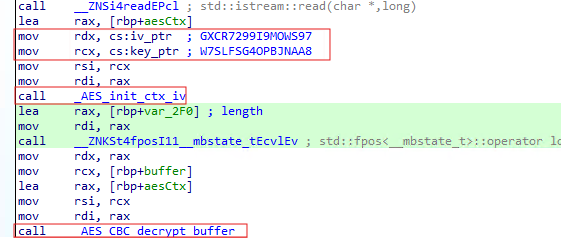

The configuration file located at /tmp/info.dat contains a list of PANs (Personal Account Numbers) which is encrypted with AES128 CBC using the opensource library "Tiny AES in C". The decryption routine uses the key W7SLFSG4OPBJNAA8 and initialization vector GXCR7299I9MOWS97.

Interception of packets

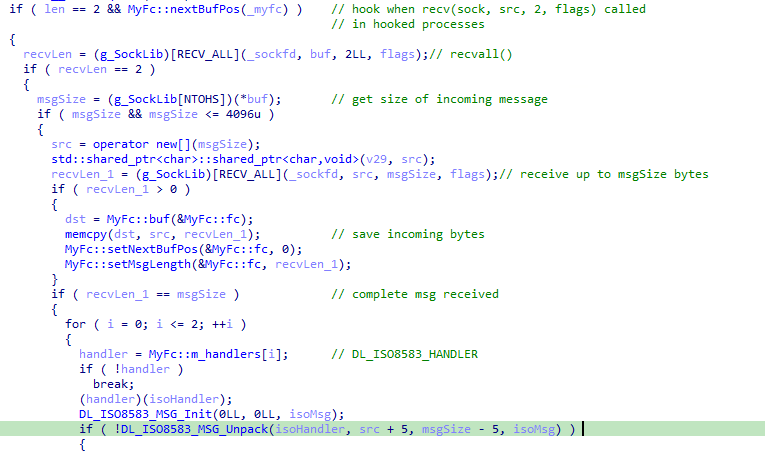

MyFc::recv maintains a "state" of incoming ISO8583 messages for a transaction which is initialized when the target process expects to receive exactly two bytes. This is the TPDU header expected to contain a 16 bit unsigned integer corresponding to a ISO8535 message size in bytes.

The hooked recv routine parses the message size from the first 2 bytes, then calls recvall until that length of data has been received, copies it into a buffer then unpacks into an ISO8583 message for parsing. Note the 5 byte offset passing in the received buffer to DL_ISO8583_MSG_Unpack. This corresponds to a 5 byte TPDU.

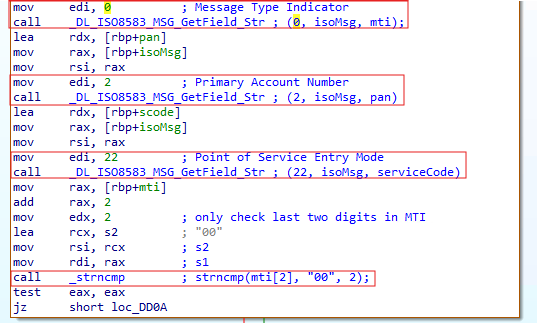

As with other variants, the "Oscar-ISO8583" C library has been used to parse and repack the ISO8583 messages. On receiving a valid ISO8583 message, MTI (Message Type Indicator) Message subclass is checked to see the origin is from the acquirer with an authorization (x100) or financial (x200) request.

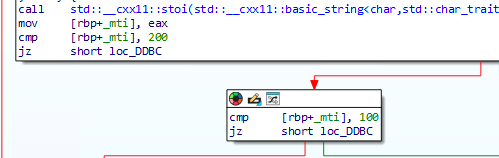

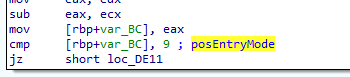

The DE22 (Point of Service entry mode) is checked to be a magnetic swipe read. The initial value in the field is expected to be three digits in BCD format. It is converted to an integer with stoi then divided by 100, effectively retaining the first digit that is then compared to the value of 9 - Magnetic Swipe. By discarding the other digits, the "PIN capability" (how the PIN was obtained) is not considered.

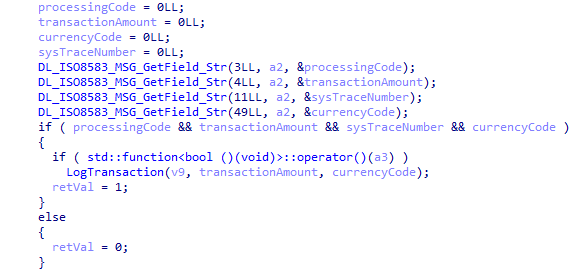

PAN in the message is then matched against the list in the decrypted configuration file. If there is a match, the the following fields are verified to be populated:

- Processing code (

DE3) - Transaction amount (

DE4) - System trace audit number (

DE11) - Currency (

DE49)

The PAN, transaction amount and currency is then logged to the file /tmp/trans.dat

Generating fraudulent responses

The real magic happens in the appropriately named MyFC::Hack. A random amount set between 12000 and 30000 (April 2022 TRY/USD exchange rate this would equate to approximately 800USD to 2,000 USD... Due to inflation Türkiye, at the time of writing, the value to the USD is less then half this. One has to wonder if the threat actor updated the figures in the malware at any stage to accommodate..) The 3rd byte in the MTI is set to 1 which represents a message response.

DE3 (processing code) is checked against two error codes: 51 (Insufficient Funds) or 48 which is "Reserved for ISO use", here likely representing a balance check.

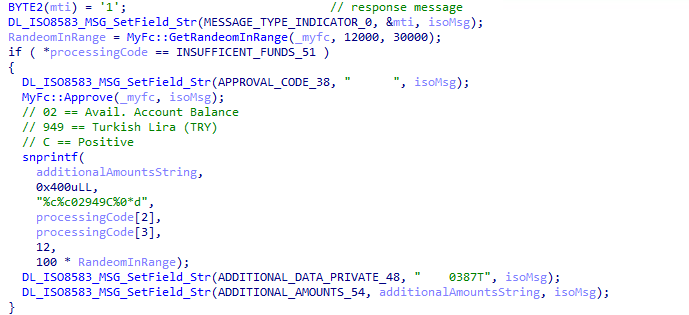

51 - Insufficient Funds

In the case of 51, insufficient funds, DE38 (approval code) is overwritten with whitespace and DE39 (Action code) set to "approve" by the Approve function.

The fraudulent balance is specified in a string of format AA VV CCC X NNNN... which is set in DE54 (Additional amounts).

According to the standard, the format is:

AAis the account typeVVis the type of amount (here02, meaning available account balance)CCCis the currency code (here949, meaningTRY)Xis either positive or negative (withCmeaning positive,Drepresents negative)NNNN..is the amount (here the random amount multiplied by100). It is possible that this amount is specified in Kuruş.

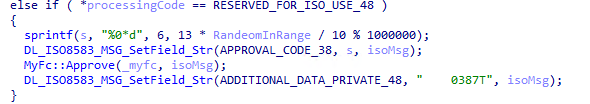

48 - Reserved for use (assumed balance check)

If a processing code of 48 is received instead of 58 (Insufficient funds), the DE38 (Approval code) is populated with the random fund amount which effectively is multiplied by 1.3 (the multiplication and division) and then is constrained to 6 digits via the modulo operation. Additionally, as with the prior, a very specific string 0387T is set in DE48 (Additional data, private) as is done in the "insufficient funds" routine. At the time of writing, the meaning of this string is undetermined.

This is likely to occur for MTI response 110 for a balance enquiry.

After the relevant processing code has been handled, there are additional modifications to remove 14 specific fields:

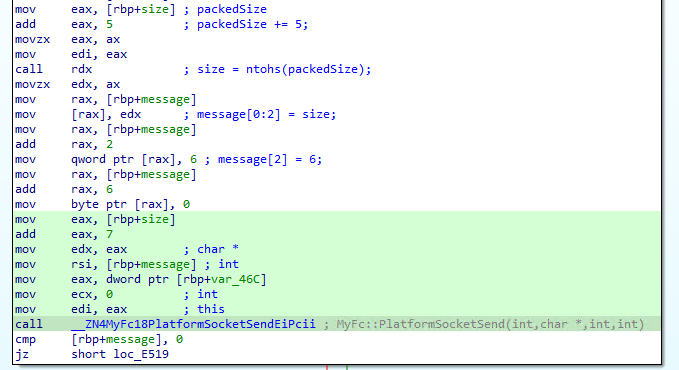

A header is assembled which contains the total length (including the header size of 5 bytes), followed by a hardcoded value of 6 which may correspond to the ID field in a TPDU header. The function PlatformSocketSend calls the send system call for the fraudulent message to be sent onwards to the acquirer.

Detection and prevention

Discovery of the Linux variant further emphasizes the need for adequate detection capabilities which are often lacking in Linux server environments. The process injection technique employed to intercept the transaction messages should be flagged by any commercial EDR or opensource Linux agent with the appropriate configuration to detect usage of the ptrace system call. As they say, prevention is better then the cure, and the recommendation are best summarized by CISA:

- Implement chip and PIN requirements for debit cards.

- Require and verify message authentication codes on issuer financial request response messages.

- Perform authorization response cryptogram validation for chip and PIN transactions.

Indicators of Compromise

SHA-256 hashes

FASTCash for Linux

f34b532117b3431387f11e3d92dc9ff417ec5dcee38a0175d39e323e5fdb1d2c (UPX)

7f3d046b2c5d8c008164408a24cac7e820467ff0dd9764e1d6ac4e70623a1071

FastCash for Windows

afff4d4deb46a01716a4a3eb7f80da58e027075178b9aa438e12ea24eedea4b0

f43d4e7e2ab1054d46e2a93ce37d03aff3a85e0dff2dd7677f4f7fb9abe1abc8

5232d942da0a86ff4a7ff29a9affbb5bd531a5393aa5b81b61fe3044c72c1c00

2611f784e3e7f4cf16240a112c74b5bcd1a04067eff722390f5560ae95d86361c3904f5e36d7f45d99276c53fed5e4dde849981c2619eaa4dbbac66a38181cbe

609a5b9c98ec40f93567fbc298d4c3b2f9114808dfbe42eb4939f0c5d1d63d44078f284536420db1022475dc650327a6fd46ec0ac068fe07f2e2f925a924db49 (RAR)

Previously identified / attributed (2018 to 2020)

129b8825eaf61dcc2321aad7b84632233fa4bbc7e24bdf123b507157353930f0 (Windows)10ac312c8dd02e417dd24d53c99525c29d74dcbc84730351ad7a4e0a4b1a0eba (AIX)3a5ba44f140821849de2d82d5a137c3bb5a736130dddb86b296d94e6b421594c (AIX)